|

办公时间:

周一至五 10:00 AM - 5:30 PM 周六, 日 11:00AM - 4:00 PM |

Office Hours:

Mon. - Friday 10:00 AM - 5:30 PM Sat. & Sun. 11:00 AM - 4:00 PM |

国税局宣布2025年1月27日为全国2025年报税季的正式开始日期, 届时国税局并开始接收和处理2024的税表. 报税截止日为4/15/2025.

对税号持有人通知 (注意,税号为 ITIN, 此号码非社会安全号码 SSN): 如果税号持有者并没有申报过 2021, 2022, 以及 2023税表.你所持有的税号将于 12/31/2024 过期.

税号中间两位数为,“70,” “71,” “72,” “73,” “74,” “75,” “76,” “77,” “78,” “79,” “80,” “81,” “82,” “83,” “84,” “85,” “86,” “87,” or “88” 已过期. 2013年前所申请税号, 中间两位数为 “90,” “91,” “92,” “94,” “95,” “96,” “97,” “98,” or “99” 已过期。已过期税号持有人请至我办公室申请更新税号.

税号中间两位数为,“70,” “71,” “72,” “73,” “74,” “75,” “76,” “77,” “78,” “79,” “80,” “81,” “82,” “83,” “84,” “85,” “86,” “87,” or “88” 已过期. 2013年前所申请税号, 中间两位数为 “90,” “91,” “92,” “94,” “95,” “96,” “97,” “98,” or “99” 已过期。已过期税号持有人请至我办公室申请更新税号.

Expired ITINs: If your ITIN wasn’t included on a U.S. federal tax return at least once for tax years 2020, 2021, and 2022, your ITIN will expire on December 31, 2023. ITINs with middle digits (the fourth and fifth positions) “70,” “71,” “72,” “73,” “74,” “75,” “76,” “77,” “78,” “79,” “80,” “81,” “82,” “83,” “84,” “85,” “86,” “87,” or “88” have expired. In addition, ITINs with middle digits “90,” “91,” “92,” “94,” “95,” “96,” “97,” “98,” or “99,” IF assigned before 2013, have expired.

重要的报税截止日期:

1/15/2025:

- 最后一次2024年预估税交付日期.

- 雇主须在1/31/2025前给雇员颁发W-2表格.

- 雇主需在1/31/2025 前将1099-NEC递交政府并且颁发给独立合同商进行报税.

- S类公司(1120S)的税表申报截止日期. (如需延期, 可将截止日期延期至9/15/2025)

- 合作伙伴类公司税表(1065)申报截止日期. (如需延期, 可将报税日期延期至9/15/2025)

- 个人税的截止日期 (如需延期, 可将报税日延期至10/15/2025)

- 2025财年第一个季度个人预存税缴付的截止日期.

- 月历年C类(1120)公司税表申报的截止日期. (如需延期, 可将截止日期延期至10/15/2025)

- 2024 IRA 退休金存储最后期限.

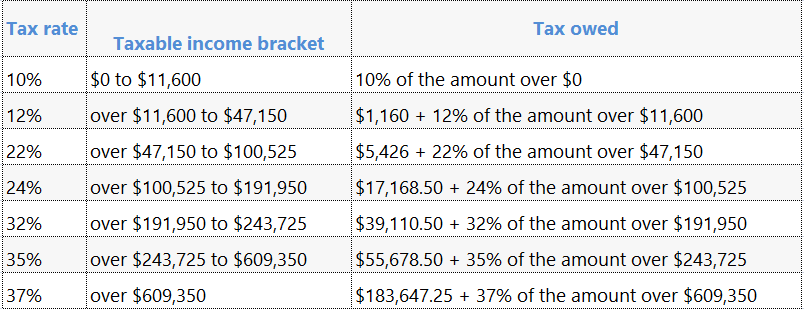

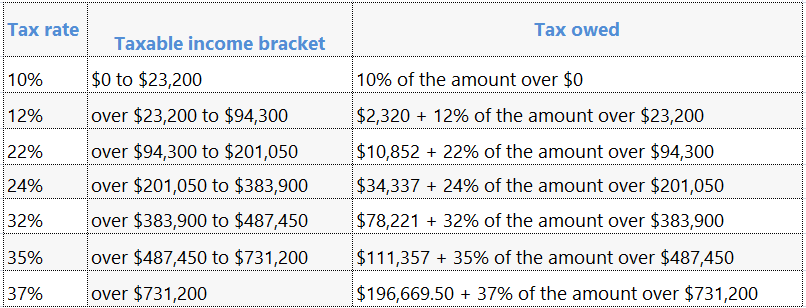

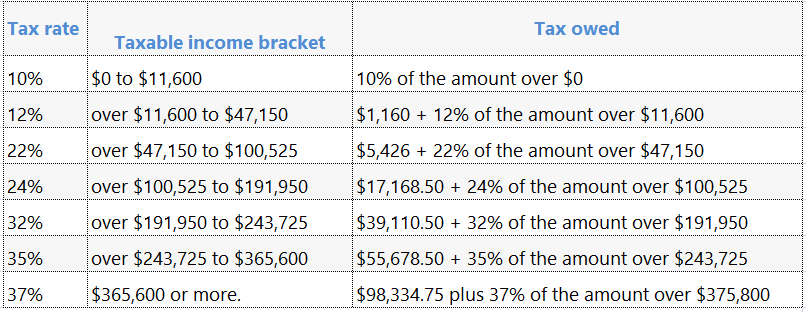

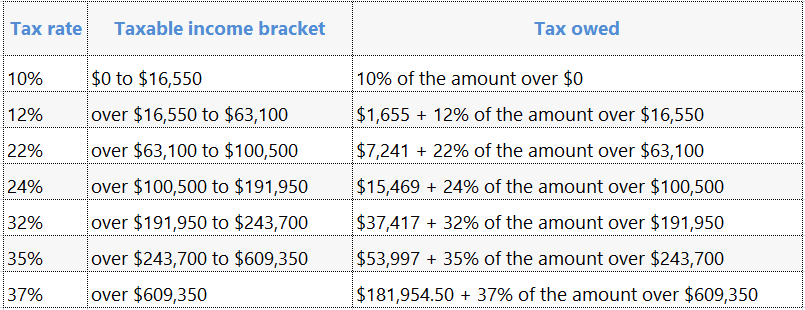

2024 Federal Income Tax Brackets for taxes due in April 2025

2025年报税季所采用2024年度税率

2025年报税季所采用2024年度税率

Single Filers 单身

Married Filing Jointly 夫妻合报

Married Filing Separately 夫妻分报

Head of Household 户主

Essential Tax Figures for Tax Season 2024 (Tax Due on 4/15/2025)

Earned Income Tax Credit table for 2024 Income Limits & Maximum Amounts

低收入经贴收入限制图表

低收入经贴收入限制图表

投资收入限额: $11,950或以下:

3个小孩或以上最多可得低收入经贴 $8,046

2个小孩最多可得低收入经贴 $7,152

1个小孩最多可得低收入经贴 $4,328

无小孩低收入经贴 $649

3个小孩或以上最多可得低收入经贴 $8,046

2个小孩最多可得低收入经贴 $7,152

1个小孩最多可得低收入经贴 $4,328

无小孩低收入经贴 $649

美国教育机会抵税

机会教育退税: 在读大学生, 第一次上大学四年内学费可享有最多 $2,500的退税额

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

13岁以下小孩, 2024支付托儿所活课后补习班的费用

1个小孩资格费用$3,000, 最高可达$1050 (Maximum Credit);

2个小孩资格费用$6,000, 最高可达$2,100 (Maximum Credit);

1个小孩资格费用$3,000, 最高可达$1050 (Maximum Credit);

2个小孩资格费用$6,000, 最高可达$2,100 (Maximum Credit);

17岁以下小孩退税 (Child Tax Credit) 每个小孩最多$2,000, 其中$1,700是可退的, 余下的额度可做税金抵免.

Child Tax Credit: $2,000, $1,700 tax credit is fully refundable.

凡家庭收入(单身/户主报税等)低于$20万都可以适用, 夫妻联合报税收入低于$40万的可以适用, 超出以上收入的可能有资格申请部分抵免.

Child Tax Credit: $2,000, $1,700 tax credit is fully refundable.

凡家庭收入(单身/户主报税等)低于$20万都可以适用, 夫妻联合报税收入低于$40万的可以适用, 超出以上收入的可能有资格申请部分抵免.

商业用车开销可减$0.67/英里;医疗用车开销可减$0.21/英里(需符合相应抵扣条件)

Business Mileage Rates $0.67 per mile; Medical Mileage Rates $0.21 per mile (Needs to meet certain conditions)

Business Mileage Rates $0.67 per mile; Medical Mileage Rates $0.21 per mile (Needs to meet certain conditions)

退休计划 Pension Plan:

- 收入 $23,000 可投入401K计划 (如果雇主有提供 401K计划给雇员)

- 标准IRA帐户可投入 $7,000, 50岁以上人士可额外投入 $1,000

- Simplified Employee Pension IRA 可投入 $69,000或者可高达收入的25%

- Simple IRA 可投入 $16,000

退休账户退税 Saver's Tax Credit : $1,000 ($2,000 if married filing jointly) 已婚合报的额度是 $2,000 (需符合相应抵扣条件)

遗产与赠与税一生豁免额: 12.092 Million(2023)

The estate tax and gift tax are subject to a combined basic exclusion amount of 12.92 Million in 2023.

The estate tax and gift tax are subject to a combined basic exclusion amount of 12.92 Million in 2023.

2025年度工作季点 (Social Security Seasonal Earning Point): $1,810算一个积分, 每年最多四个积分, $7,240 的W2金额可获得四个积分.

2024年度工作季点 (Social Security Seasonal Earning Point): $1,730算一个积分, 每年最多四个积分, $6,920 的W2金额可获得四个积分.

2024年度工作季点 (Social Security Seasonal Earning Point): $1,730算一个积分, 每年最多四个积分, $6,920 的W2金额可获得四个积分.

|

2024 亲属移民最低收入线: (除Alaska & Hawaii)

$25,550/ 2口之家; $32,275/ 3口家; $39,000/ 4口之家, $45,725/ 5口之家 每增加一口需增加 $6,725收入. |

2024 Minimum Income requirements for Form I-864

2 Household Size Sponsor's Income $25,550 3 Household Size Sponsor's Income $32,275 4 Household Size Sponsor's Income $39,000 5 Household Size Sponsor's Income $45,725 Add $6,725 for each additional person. |

|

2024年联邦贫困线标准

Federal Poverty Guidelines 2023: $15,060 / 单身; $20,440 / 2口之家; $25,820 / 3口之家; $31,200/ 4口之家; 每增加一个成员加$5,380 |

纽约州 Medicaid 最高收入要求:

單身不超过 $20,783 夫妻两人不超过 $28,208 三口之家不超过 $35,632 四口之家不超过 $43,056 五口之家不超过 $ 50,481 每增加一个成员加 $7,425 |

2024年ESSENTIAL PLAN 医疗保险

单身不超过 $37,650 夫妻不超过 $51,100 三口之家不超过 $ 64,550 四口之家不超过 $ 78,000 五口之家不超过 $ 91,450 每增加一个成员加$13,450 |

接受美国境内亲属赠与 Annual Gift Exclusion : 2025超过 $19,000 需申报礼品税 Gift Tax

海外账户申报额度 Report of Foreign Bank and Financial Accounts (FBAR);

超过$10,000 需申报

申报截止日期为: 4/15/2025

超过$10,000 需申报

申报截止日期为: 4/15/2025

接受海外汇款超过 $100,000 需申报

2024 年海外收入豁免额 (Foreign Earned Income Exclusion): $126,500

最低替代税免税额 (Alternative Minimum Taxable Income Exemption): 个人 $85,700; 已婚合报 $133,300; 夫妻分报 $66,650

北美税务会计师事务所

North America Tax & Accounting LLC

Address: 135-53 Northern Blvd, Ste 2C, Flushing, NY 11354

Telephone: 718.886.3935 / 917.285.2297

Fax: 718.307.7073

Email: info@nataxes.com

North America Tax & Accounting LLC

Address: 135-53 Northern Blvd, Ste 2C, Flushing, NY 11354

Telephone: 718.886.3935 / 917.285.2297

Fax: 718.307.7073

Email: info@nataxes.com